- Home

- Contact Us

-

- Rates

-

- Conventional - Home Possible + DPA

- 780 to 850 Credit Score Rates

- 760 to 779 Credit Score Rates

- 740 to 759 Credit Score Rates

- 720 to 739 Credit Score Rates

- 700 to 719 Credit Score Rates

- 680 to 699 Credit Score Rates

- 660 to 697 Credit Score Rates

- 640 to 659 Credit Score Rates

- 620 to 639 Credit Score Rates

-

- Conventional - 3% Down Purchase

- 780 to 850 Credit Score Rates

- 760 to 779 Credit Score Rates

- 740 to 759 Credit Score Rates

- 720 to 739 Credit Score Rates

- 700 to 719 Credit Score Rates

- 680 to 699 Credit Score Rates

- 660 to 679 Credit Score Rates

- 640 to 659 Credit Score Rates

- 620 to 639 Credit Score Rates

-

- Conventional - 5% Down Purchase

- 780 to 850 Credit Score Rates

- 760 to 779 Credit Score Rates

- 740 to 759 Credit Score Rates

- 720 to 739 Credit Score Rates

- 700 to 719 Credit Score Rates

- 680 to 699 Credit Score Rates

- 660 to 679 Credit Score Rates

- 640 to 659 Credit Score Rates

- 620 to 639 Credit Score Rates

-

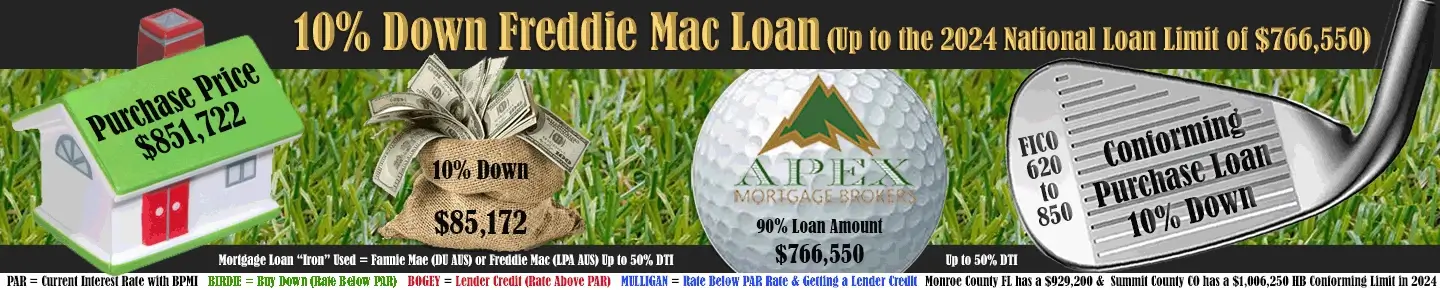

- Conventional - 10% Down Purchase

- 780 to 850 Credit Score Rates

- 760 to 779 Credit Score Rates

- 740 to 759 Credit Score Rates

- 720 to 739 Credit Score Rates

- 700 to 719 Credit Score Rates

- 680 to 699 Credit Score Rates

- 660 to 679 Credit Score Rates

- 640 to 669 Credit Score Rates

- 620 to 639 Credit Score Rates

-

- Conventional - 20% Down Purchase

- 780 to 850 Credit Score Rates

- 760 to 779 Credit Score Rates

- 740 to 759 Credit Score Rates

- 720 to 739 Credit Score Rates

- 700 to 719 Credit Score Rates

- 680 to 699 Credit Score Rates

- 660 to 679 Credit Score Rates

- 640 to 659 Credit Score Rates

- 620 to 639 Credit Score Rates

-

- Calculators